Trade like a PRO

Backtest and trade smarter. The quant research platform for stock and crypto traders.✨

Users

Winning Strategies

Trading Signals

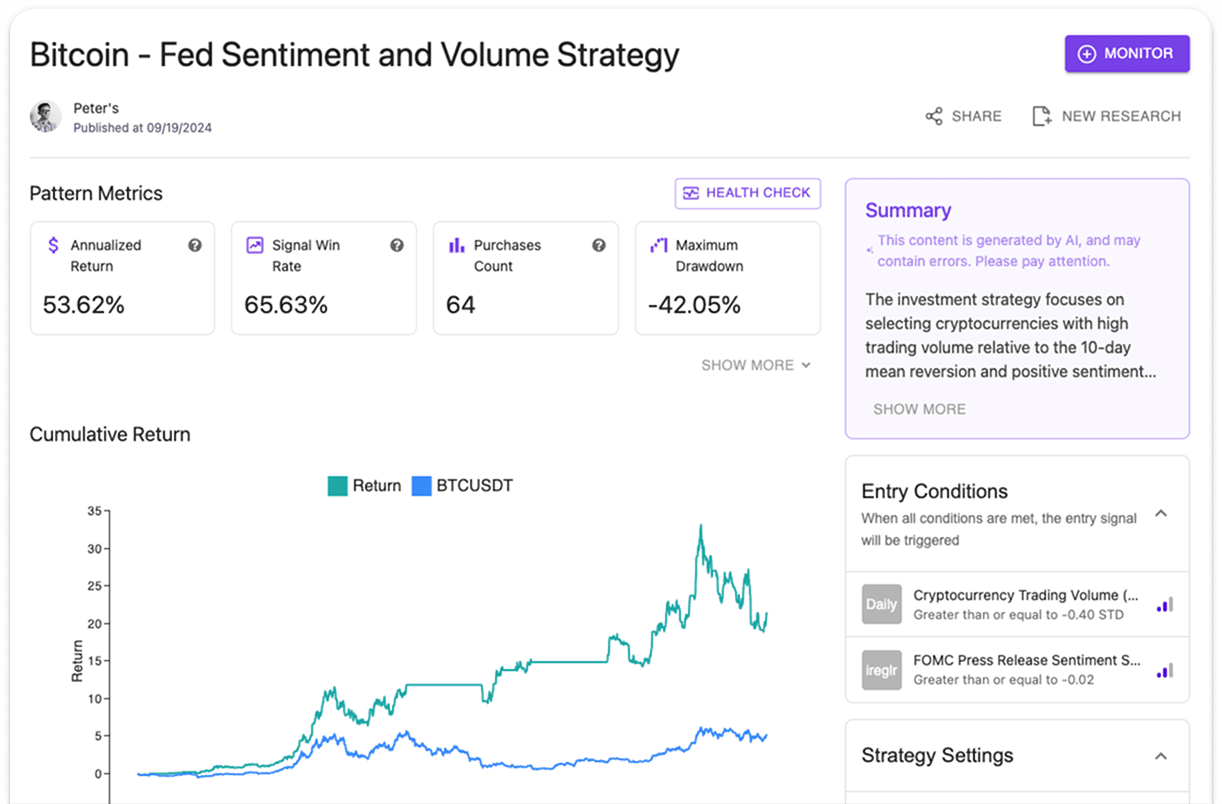

Ephod Intelligence is a quantitative research SaaS (Software as a Service) platform designed specifically for investors, helping users generate personalized trading strategies and signals through non-linear algorithms.

The Ephod platform combines multiple factors to provide efficient stock screening, monitoring and strategy optimization functions.

No Coding Needed.

Anyone Can Build Quant Research.

No Manual Tuning.

Let the System Find the Best Investment Patterns.

Efficient Algorithms and Quality Data for Fast, Accurate Backtest Reports and Market Monitoring.

Incorporating Hundreds of Research Factors—Macro, Fundamentals, Analyst Expectations—to Build Precision Strategy Models.

The Ephod platform supports professional fund managers and individual investors in making data-driven decisions and integrates market data and AI tools from top suppliers to help you discover market insights.